The Buy Now, Pay Later (BNPL) feature for invoices, is an option that allows your customers to defer payments using services like Klarna and Afterpay. This functionality, integrated with your payment system, can now be used not only for e-commerce transactions but also for invoicing, providing greater flexibility and convenience for your clients.

Easy Steps to Use BNPL for Invoices

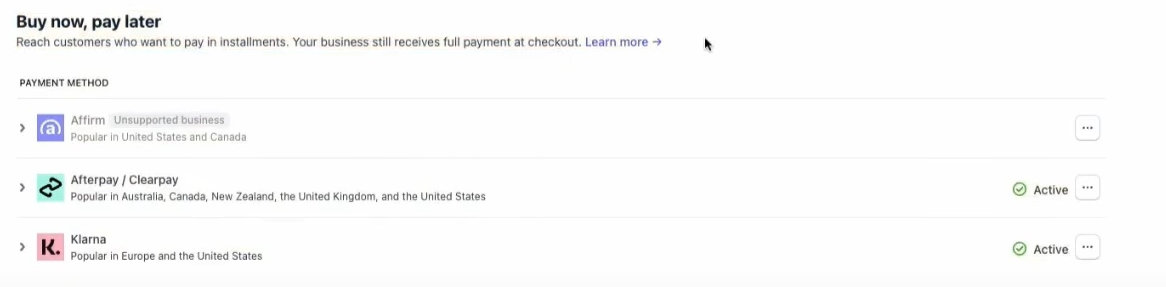

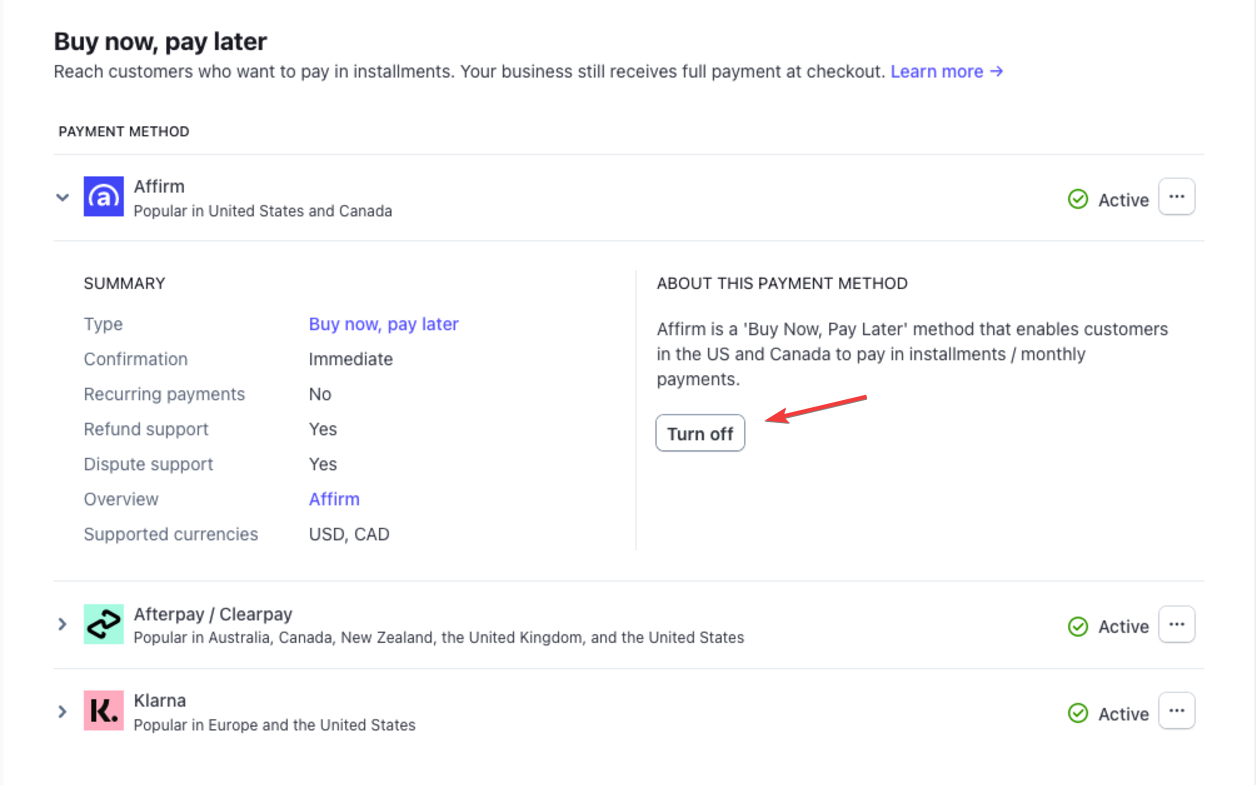

1. Ensure BNPL is Enabled in Your Payment Settings

- Access Payment Integrations: Log in to your Stripe account and navigate to Settings > Connect > Payment methods.

- Enable BNPL: Ensure that BNPL options like Klarna and Afterpay are enabled.

Remember to select LeadConnector configurations in the dropdown here since there can be more platforms your Stripe account is connected to. Refer to the image below:

Important: Make sure your stripe account is enabled to use these payment methods.

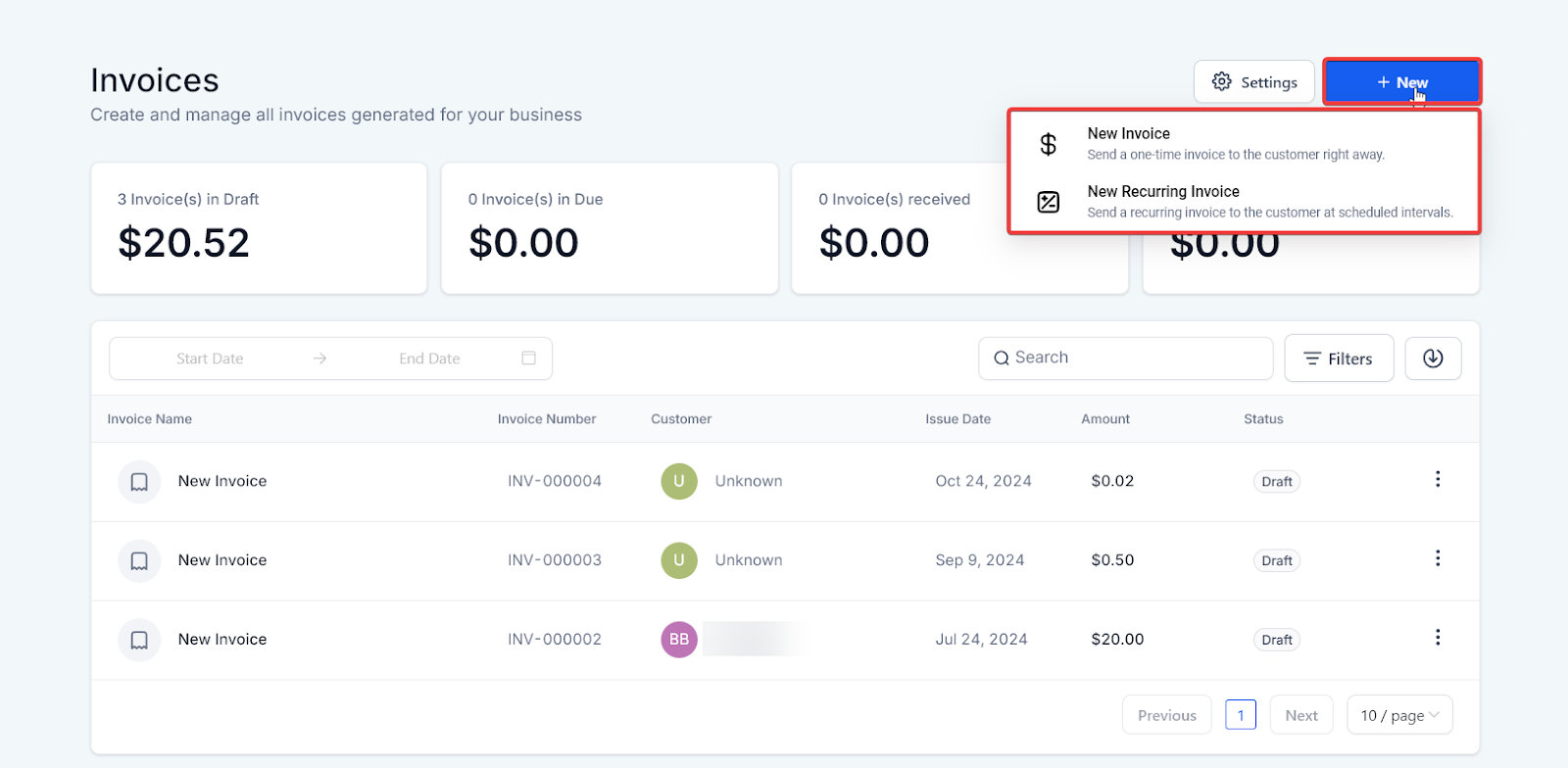

2. Create and Send an Invoice

- Create an Invoice: Navigate to Payments on the left > Invoices & Estimates > From the dropdown select All Invoices

- Send the Invoice: Send the invoice to your customer as you normally would.

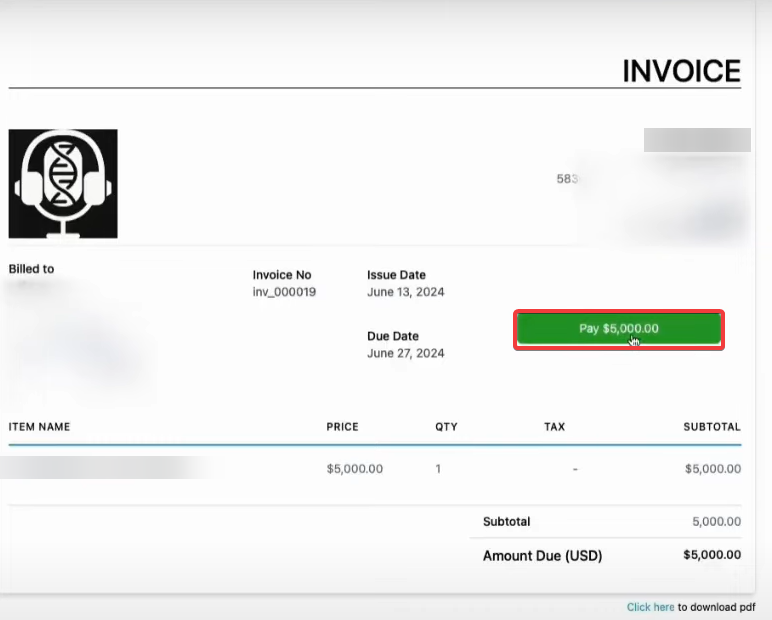

3. Customer Pays the Invoice

- Open the Invoice: When your customer receives the invoice, they will open it to view the payment options.

- Select Payment Method: The customer will see the standard payment methods, such as card or bank transfer, along with BNPL options like Klarna and Afterpay.

- Choose BNPL: The customer can select a BNPL option to defer their payment.

4. Complete the Payment

- Follow BNPL Instructions: The customer follows the prompts to complete their purchase using the chosen BNPL service.

- Confirm Payment: Once the payment is processed, you will receive confirmation, and the payment will be recorded in your system.

Pro Tips

- Verify Eligibility: Before enabling BNPL, verify that your business type is supported by the BNPL providers.

- Monitor Settings: Regularly check your payment settings to ensure BNPL options are correctly configured.

- Customer Communication: Clearly inform your customers about the availability of BNPL options on their invoices to increase adoption.

Use Cases

Improved Cash Flow Management

Businesses can benefit from BNPL by offering flexible payment options that encourage customers to pay their invoices more promptly, thus improving cash flow.

Increased Sales

By providing BNPL options, you can attract more customers who might be hesitant to pay the full amount upfront, leading to increased sales and customer satisfaction.

Customer Convenience

Offering BNPL adds convenience for your customers, allowing them to manage their finances better and fostering a positive relationship with your business.

FAQ

Q: Are there any additional fees for using BNPL?

A: Fees for using BNPL services may vary by provider. Check with your payment provider for specific details on any associated fees.

Q: Can I disable BNPL options if I choose not to offer them?

A: Yes, you can disable BNPL options by accessing your payment settings and turning off the specific BNPL services you do not wish to offer.

Q: Is BNPL available for recurring invoices?

A: Yes, BNPL can be used for both one-time and recurring invoices, providing flexibility for various billing scenarios.

Was this article helpful?

That’s Great!

Thank you for your feedback

Sorry! We couldn't be helpful

Thank you for your feedback

Feedback sent

We appreciate your effort and will try to fix the article